Farm equipment depreciation calculator

Fill out IRS Form 4562 Depreciation and Amortization. Find the depreciation rate for a business asset.

How To Calculate Depreciation Expense For Business

Depreciation is the annual deduction allowed to recover the cost or other basis of business or investment property having a useful life substantially beyond the tax year.

. Depreciation is the allocation of cost of an asset among the time periods when the asset is used. Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation Finds the daily monthly yearly and total appreciation or depreciation rates based. For example the cost of a machine that is used to produce products during several production.

We welcome your comments about this publication and suggestions for future editions. Calculate depreciation for a business asset using either the diminishing value. Depreciation calculator for Photocopiers under the category of Office Equipment for use in insurance claims adjusting.

You can send us comments through IRSgovFormCommentsOr you can. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Section 179 deduction dollar limits.

Where Di is the depreciation in year i. By developing annual costs for equipment producers have an estimate of farm machinery costs that can be used in enterprise budgeting and whole-farm planning as well as decisions such as. The MACRS Depreciation Calculator uses the following basic formula.

This limit is reduced by the amount by which the cost of. Office Equipment - Photocopiers Depreciation Rate. Calculate Your Depreciation.

Office Equipment - Calculator Depreciation Rate. You can use this tool to. D i C R i.

Use the Below Calculator to Check Your Tax Write Off. Depreciation calculator for Calculator under the category of Office Equipment for use in insurance claims adjusting. C is the original purchase price or basis of an asset.

The Section 179 Tax Deduction encourages agri businesses to stay competitive by purchasing shortline equipment which. Depreciation rate finder and calculator. If you qualify for and elect to deduct the whole tractor under Section 179 rules.

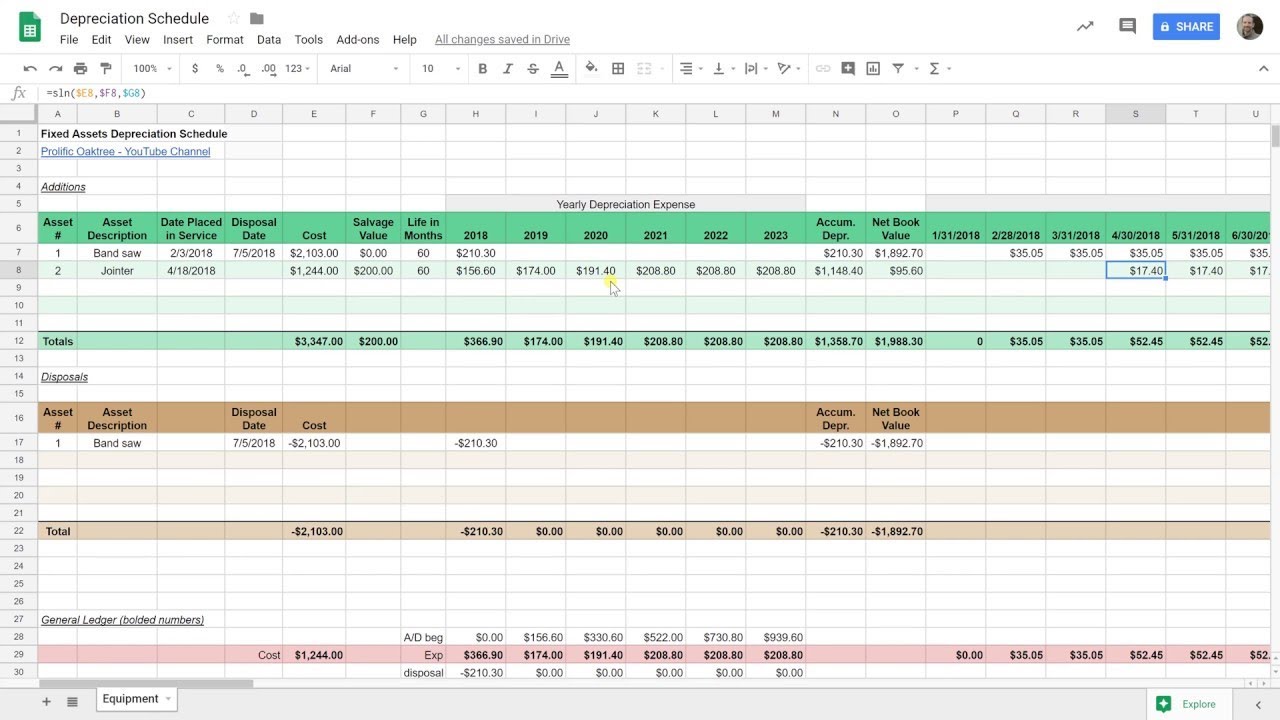

Create A Depreciation Schedule In Google Sheets Straight Line Depreciation Youtube

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Asset Inventory Sheet Template Excel Spreadsheets Templates Excel Templates Templates

Types Of Accounts Accounting Simpler Enjoy It Accounting Capital Account Loan Account

Revaluation Method Of Calculating Depreciation Accounting Simpler Enjoy It Method Calculator Accounting

Macrs Depreciation Calculator Straight Line Double Declining

Depreciation Macrs Youtube

Types Of Accounts Accounting Simpler Enjoy It Learn Accounting Accounting Online Accounting

Depreciation Formula Calculate Depreciation Expense

Methods Of Calculating Depreciation Accounting Simpler Enjoy It Method Calculator Accounting

Grant Proposal Checklist Template Budget Template Budgeting Worksheets Worksheet Template

Cash Flow Projection Template Flow Chart Template Cash Flow Cash Flow Statement

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

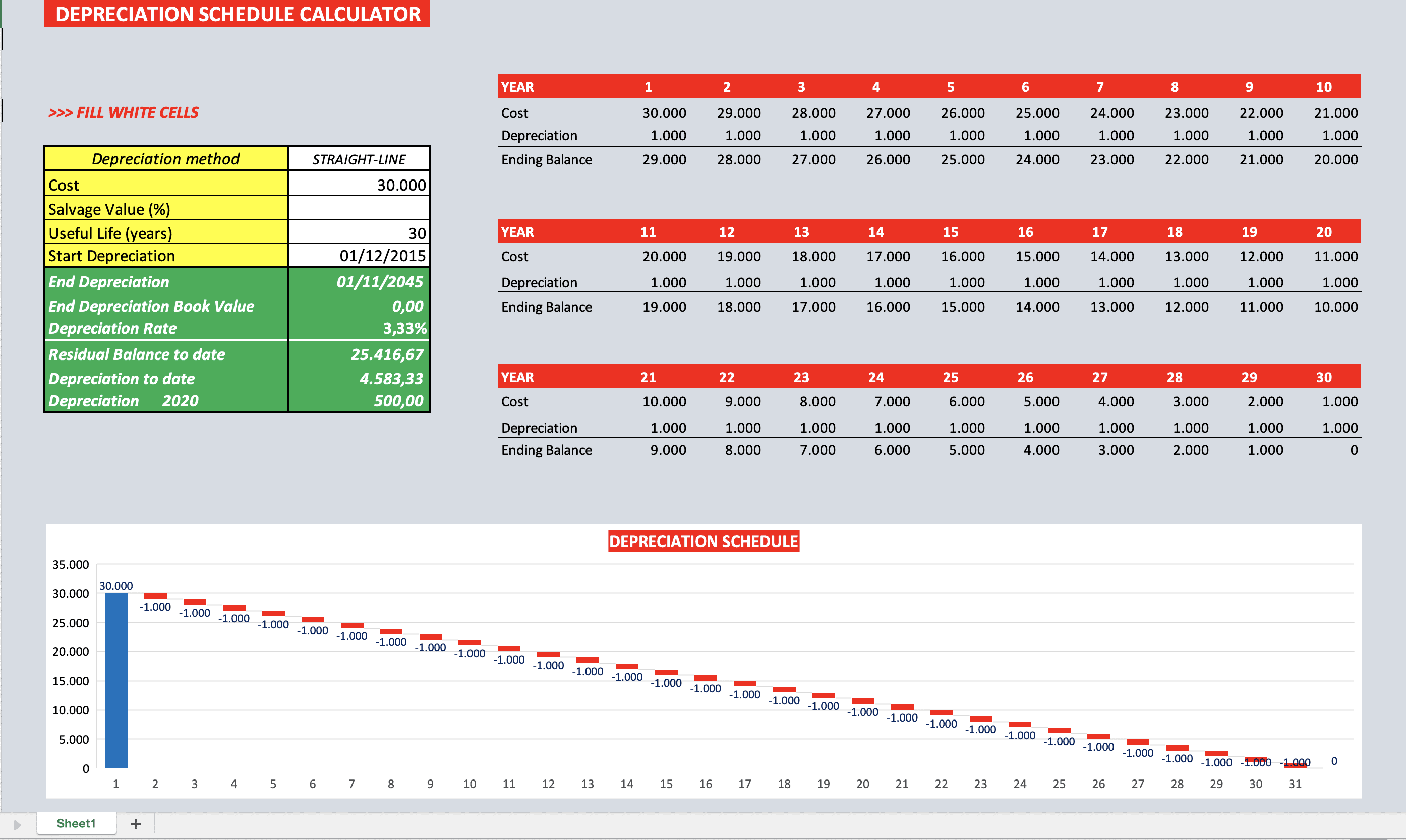

Depreciation Schedule Calculator Efinancialmodels

Macrs Depreciation Calculator Based On Irs Publication 946

Poultry Expenditure Poultry Poultry Business Poultry Farm

Depreciation And Farm Machinery A Rule Of Thumb Grainews